DebtBlue’s Advantage Loan:

The Best Way to Beat Credit Card Debt

It’s Fast. It’s Easy. And Your Credit Will Thank You.

DebtBlue’s Advantage Loan

How Does It Work?

Get Started

Stay Committed

Stay diligent in the program for as little as 6 months; DebtBlue negotiates a settlement.

Leverage Our LOC

A DebtBlue Advantage Line of Credit (LOC)** is used to pay off remaining credit card balances.

Gain an Advantage You!

Free Advantage Loan Information

DebtBlue’s Advantage Line of Credit: Our “Secret Sauce”

Our Advantage Line of Credit isn’t like the others. It leaves your credit score intact, which is how it’s different. That means you’ll be able to qualify for a mortgage or auto loan faster with DebtBlue’s Advantage Line Of Credit.

- Our Line of Credit restores ratios to re-establish credit

- Creditors are paid off in as little as 6 months

- Zero balance with creditors — No utilization

- No long-term negative mark on tradelines — shows “paid to zero balance”

- New open tradeline with a smaller balance

- Establishes new payment history/seasoning with just 4-5 payments

- Retros back to the start of the plan to show age of credit

PAY OFF high-interest credit cards

KEEP your credit score for future needs

SECURE one low, fixed monthly payment

Let Our Professional Negotiations Team Go to Work for You

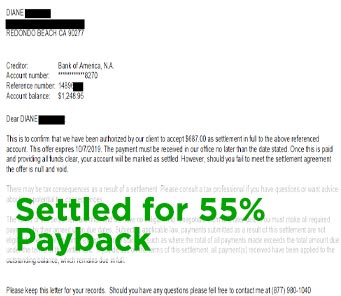

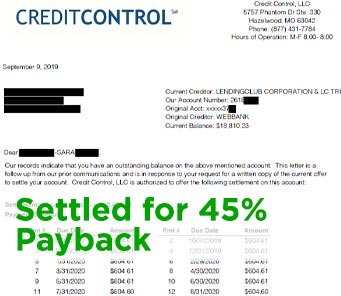

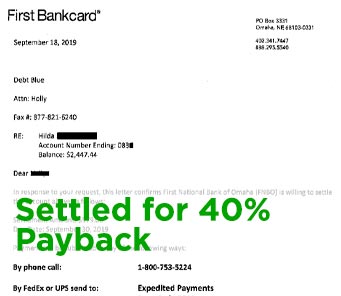

Credit Card Companies are Reducing More Than 50% of Our Client’s Balances

Our team of expert negotiators is available to negotiate on your behalf. Pay half of what you owe with it reported as “paid to $0 balance.” Check out settlement letters from our a few clients:

$18,810 Owed, Settled for Only $8,464

$2,447 Owed, Settled for Only $979